Every day, people waste thousands of dollars simply because they don’t know what to ask.

Every day, people waste thousands of dollars simply because they don’t know what to ask.

- You bought a car and overpaid by $5,400—just because you didn’t check the right credit score.

- Your dream home is out of reach, not because you can’t afford it, but because of a simple credit mistake.

- You’re paying sky-high interest on credit cards, thinking you’re making progress—but you’re actually stuck.

- A billing error went to collections, and now your credit is suffering—even though it wasn’t your fault.

Are You Facing a Financial Challenge or Decision?

When You Do Everything You're Told—and Still Get Nowhere

Carol is like so many others trying to take control of their financial future. She’s responsible, determined, and motivated to improve her credit. But no matter how many steps she takes, she feels like she’s running in circles—and getting nowhere. Months ago, Carol put her trust in a credit repair specialist. She paid money, followed every instruction, and waited. But after all the promises and effort:

❌ Her credit score didn’t improve.

❌ She kept repeating the same steps, over and over.

❌ No clear progress, no real results.

Now, Carol is faced with a tough realization: "Am I wasting my time and money? Why am I still stuck?"

We Paid Off the Debts—So Why Are We Still Stuck?

Jose and his wife didn’t wait for a miracle. They got to work:

- They paid off old debts.

- They cleared accounts and gathered payment receipts.

- They combed through every detail on their credit report.

But even after all that effort, doubt lingers:

“What if we’re still not doing enough? What if her credit doesn’t improve, and we lose our chance at a home?”

❌ The fear of being stuck—despite doing everything right—is overwhelming.

Jose is not just trying to raise a credit score; he’s trying to secure a future where his family can feel safe, stable, and finally at peace.

She’s doing her best, but no matter how hard she tries, she’s stuck.

❌ Maxed out credit cards (75% utilization dragging down her score)

❌ High interest rates stealing her money (26%-29% APR means she’s barely making progress)

❌ A laptop that should have cost $1,500 ballooned to $4,000 (because of hidden fees & interest)

❌ A billing dispute with her phone company ended up in collections (hurting her credit for years)

She isn’t irresponsible—she just didn’t know. And it’s costing her a future she deserves.

She isn’t irresponsible—she just didn’t know. And it’s costing her a future she deserves.

Starting Over Is Hard Enough—But What If Your Past Won’t Let You Move Forward?

Starting Over Is Hard Enough—But What If Your Past Won’t Let You Move Forward?

Charlie's life took a difficult turn when he filed for Chapter 13 bankruptcy. After years of financial hardship, he fought his way through the process, and by December, he had officially paid off every last cent of his debt.

- He should have been free—ready for a fresh start.

- He should have been on his way to buying his dream home

But instead, Charlie found himself facing a harsh reality:

❌ His credit score was stuck in the low 600s—not high enough for mortgage approval.

❌ Old, inaccurate information from the bankruptcy was still haunting his credit report.

❌ 18 negative accounts were dragging him down—some of which were reporting errors.

❌ One account incorrectly showed a 60-day late payment that never actually happened.

“I’ve done everything right. Why am I still being punished for my past?”

A Divorce, A Fresh Start, But a Mountain of Debt

A Divorce, A Fresh Start, But a Mountain of Debt

Aalyiah’s life took an unexpected turn when she went through a divorce. Two years ago, overwhelmed by the emotional toll, she made a decision: She let everything go.

- Credit cards went unpaid.

- A repossession scarred her credit report.

- Medical bills from seven years ago resurfaced.

- A billing mistake from her phone company landed her in collections.

At first, she didn’t even check her credit. It was too painful. But when she was finally ready to move forward and buy a home, reality hit her hard.

❌ Credit Karma showed she had a 600 score.

❌ Her lender pulled her actual FICO score: 533.

❌ She needed at least a 620 to qualify for a mortgage.

A dream she had been working toward suddenly felt impossible.

A dream she had been working toward suddenly felt impossible.

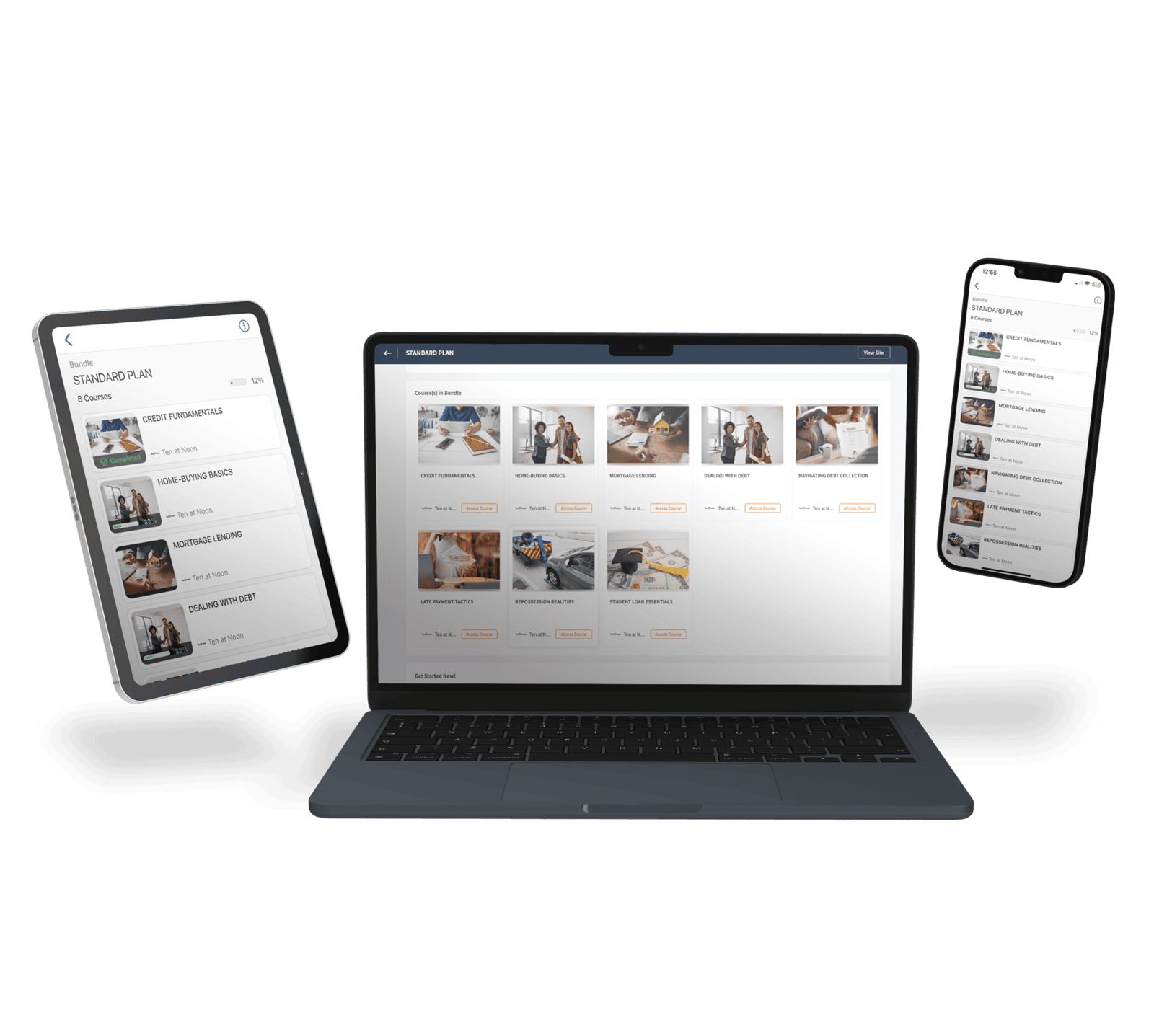

TenAtNoon - your money masterclass in 10 minutes a day.

Knowledge that puts YOU in control.

Bite-Sized Videos

We don’t waste your time with long courses or complicated jargon. We deliver answers in less than 10 minutes.

Instant Access

Select your topic and learn the critical steps to avoid overpaying.

New Content Every Month

Get fresh actionable financial strategies to keep more money in your pocket.

Real-World Experts

Learn from a valuable network of financial industry experts with real-world experience.

Grow smarter with your finances every day.

Expert Knowledge in Your Pocket.

Great money decisions don’t come from one source–they come from many. That’s why we bring you a network of financial industry experts with real-world experience for this money masterclass. Its the kind of expertise that would cost you thousands—if you even knew where to look. They provide you with quick answers, but true answers.

Shaun Spector

Attorney

15+ Years Experience

Leigh Lester Founder/Executive Director Housing Counseling

20+ Years Experience

Christine Beckwith

Senior Executive Mortgage Industry Veteran

36+ Years Experience

Tony Hutchinson

Senior VP of Industry and Government Relations

30+ Years Experience

Christopher Viale

President and Chief Executive Officer

25+ Years Experience

Kevin Peranio

Chief Lending Officer

25+ Years Experience

Katya Zevallos

Executive Director and Credit

15+ Years Experience

Elizabeth Sdoucos

CEO & Host

20+ Years Experience

Dr. Andrada Pacheco

EVP, Chief Data Scientist

20+ Years Experience